Hannover Re lifts retrocession cover to €1.2bn for 2025 as K-Cessions sidecar shrinks again

This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

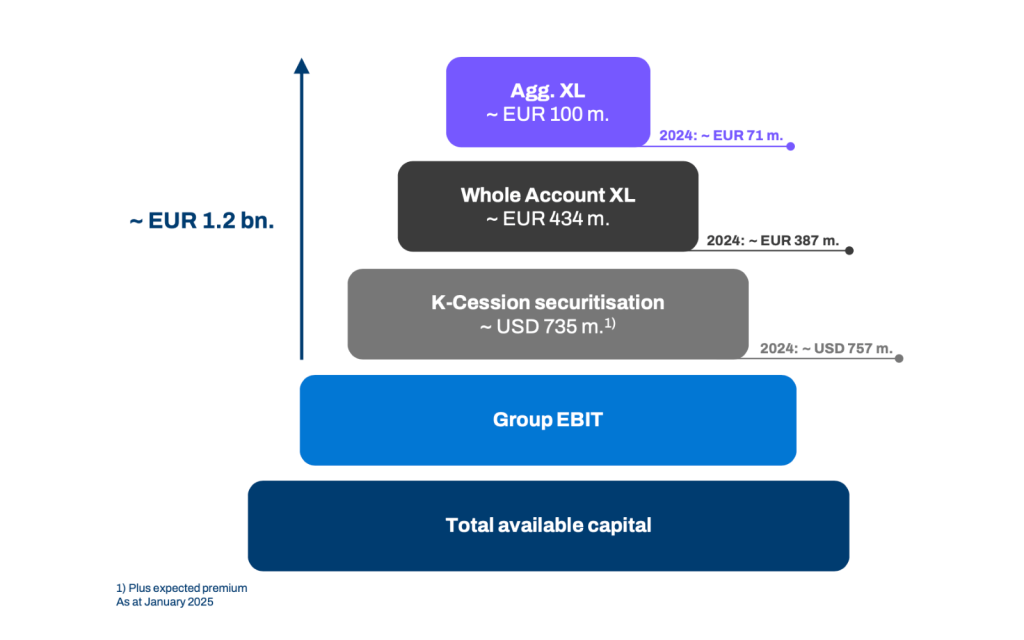

Global reinsurer Hannover Re increased its natural catastrophe retrocession protections at the January 1st, 2025, reinsurance renewals by EUR 100 million to a little more than EUR 1.2 billion, with growth in the aggregate excess of loss and whole account excess of loss covers more than offsetting a reduced K-Cessions sidecar for the year.

This morning, Hannover Re provided an update on the outcome of its 1.1 2025 reinsurance renewals, during which the firm achieved premium growth of 7.6% in traditional property and casualty reinsurance, with an average inflation and risk-adjusted price decline of 2.1%.

At the renewals, the reinsurer increased its natural catastrophe retrocession in line with plan, with no change to the overall structure of the tower, although did reduce proportional cessions to 33% and increase its non-proportional protection.

Hannover Re says that there was sufficient nat cat capacity available in the retro market at 1.1 2025, with risk-adjusted pricing slightly down when compared with the 1.1 2024 renewals.

Overall, the German reinsurer’s retro protection has risen by 9% to over EUR 1.2 billion for 2025 from EUR 1.1 billion in 2024, although the programme is still roughly 10% smaller than it was for 2023 when it increased to EUR 1.34 billion.

As in 2024, the company’s retro tower is comprised of three layers – the K-Cession sidecar, a whole account excess of loss layer, and an aggregate excess of loss layer at the top of the programme.

Starting with the bottom layer of the three, the K-Cessions quota share sidecar, Hannover Re has opted to reduce the size for 2025 by around 3% to $735 million, compared with $757 million in 2024. In fact, the size of the sidecar for 2025 is 12% lower than in 2023 when Hannover Re increased it to $831 million from $450 million in 2022.

Artemis reported recently that Hannover Re had been assessing its risk management need in relation to the K-Cessions quota share sidecar for the second year running, with the firm explaining that there’s more upside to retaining more risk while market conditions remain attractive.

Hannover Re’s retrocessional reinsurance arrangements for 2025 can be seen in the diagram below:

As evidenced above, while the K-Cessions sidecar reduced in size at the Jan 1 2025 renewals, the other two layers grew in size.

The whole account excess of loss layer sits above the K quota share sidecar and for 2025 has increased in size by more than 12% to EUR 434 million, compared with EUR 387 million in both 2024 and 2023, and EUR 276 million in 2022.

The smallest layer of retro coverage for Hannover Re is the aggregate excess of loss layer, which for 2025 the company has decided to increase in size by 41% to EUR 100 million compared with EUR 71 million in 2024 and 2023, and EUR 113 million in 2022.

Hannover Re’s increased retro protection for the year comes as the large European carrier further grew its overall portfolio at the 1.1 2025 renewals, with the firm’s Chief Executive Officer, Jean-Jacques Henchoz, noting that demand for “high-quality reinsurance capacities was once again higher than in the previous year.”

“Thanks to our very healthy capitalisation, we were able to offer our clients more reinsurance protection at appropriate conditions,” said the CEO.

Hannover Re lifts retrocession cover to €1.2bn for 2025 as K-Cessions sidecar shrinks again was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.